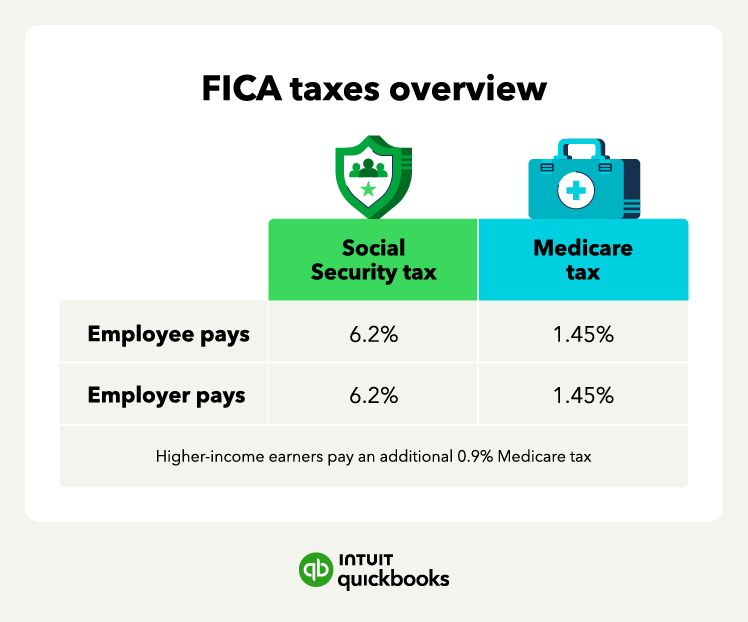

Fica Tax Rate 2024 Medicare Premium. — fica requires employers to withhold 6.2% social security tax and 1.45% medicare tax from an employee’s gross wages. — overall, the fica tax rate is 7.65%:

— overall, the fica tax rate is 7.65%: In 2024, the medicare tax rate is 2.9%, split evenly between employers and employees.

Fica Tax Rate 2024 Medicare Premium Images References :

Source: jillirosamund.pages.dev

Source: jillirosamund.pages.dev

Fica And Medicare Rates 2024 Ricki Ursula, — what is the fica tax rate in 2024?

Source: rheaqladonna.pages.dev

Source: rheaqladonna.pages.dev

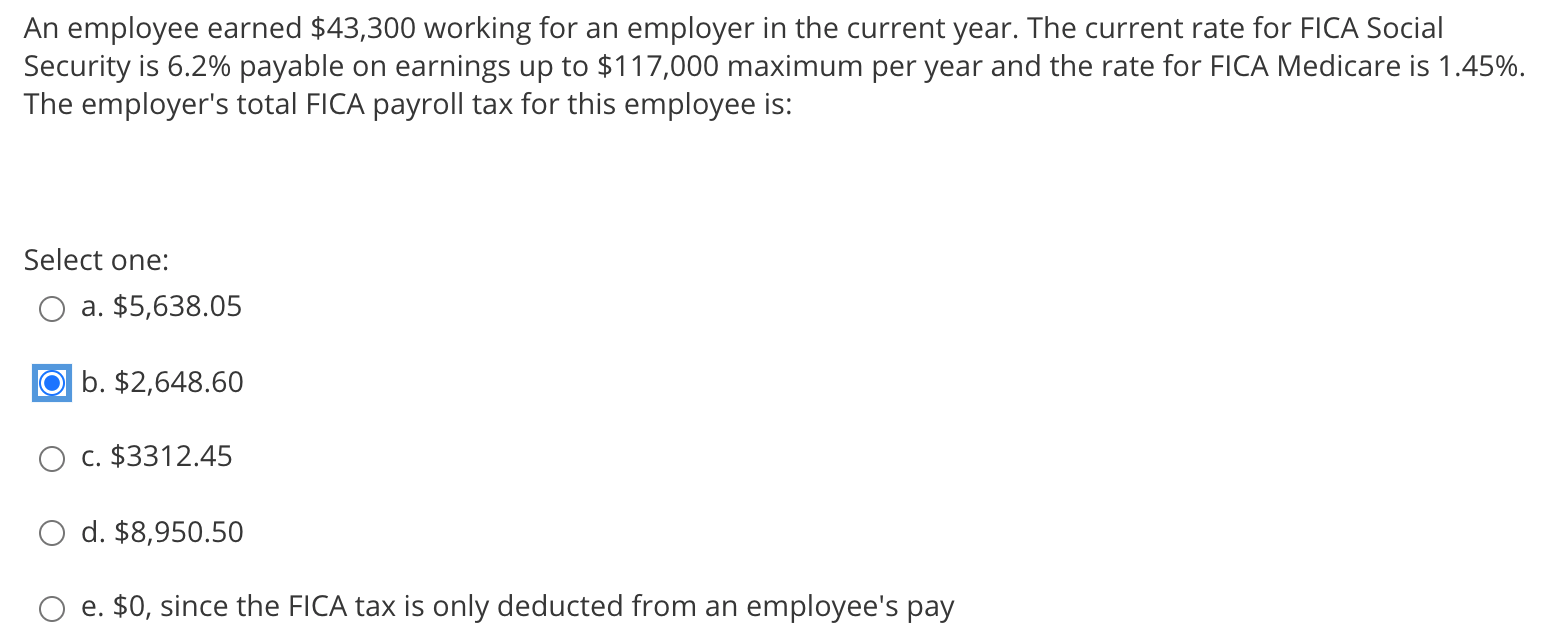

Medicare Premium Tax Brackets 2024 Betty Chelsey, [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare tax for.

Source: zaharawkaren.pages.dev

Source: zaharawkaren.pages.dev

Fica And Medicare Tax Rates 2024 Adara, 6.2% goes toward social security tax and 1.45% goes toward medicare tax, which helps fund benefits for children, retirees and the.

Source: chadbroxane.pages.dev

Source: chadbroxane.pages.dev

2024 Fica And Medicare Rates Carly Marice, — this is your definitive guide to understanding the fica tax rate for 2024.

Source: naomalinnie.pages.dev

Source: naomalinnie.pages.dev

Fica Medicare Rates 2024 Libby Rebbecca, It’s important to note that there is an additional.

Source: louisettewtove.pages.dev

Source: louisettewtove.pages.dev

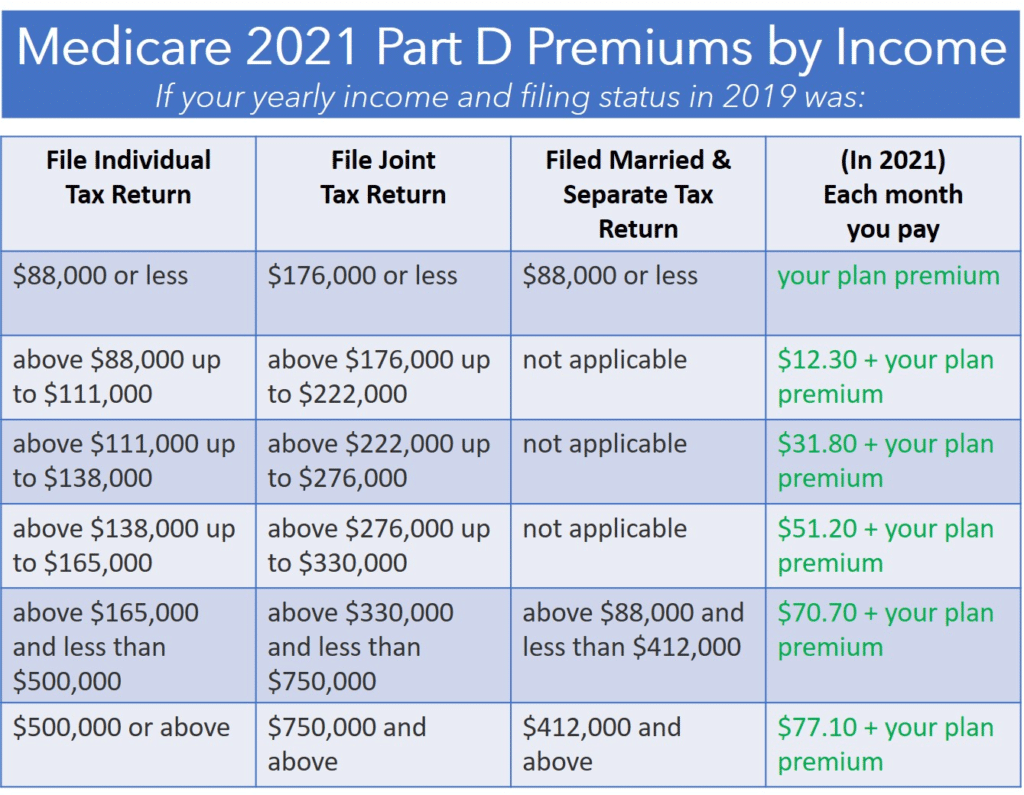

Medicare Tax Brackets 2024 Chart Corri Doralin, You can only deduct as much as your business.

Source: roxanewjesse.pages.dev

Source: roxanewjesse.pages.dev

What Is The Fica And Medicare Rate For 2024 Delia Giuditta, To find the total fica tax withheld from employee's wages, add the social security tax and the medicare tax:

Source: imagetou.com

Source: imagetou.com

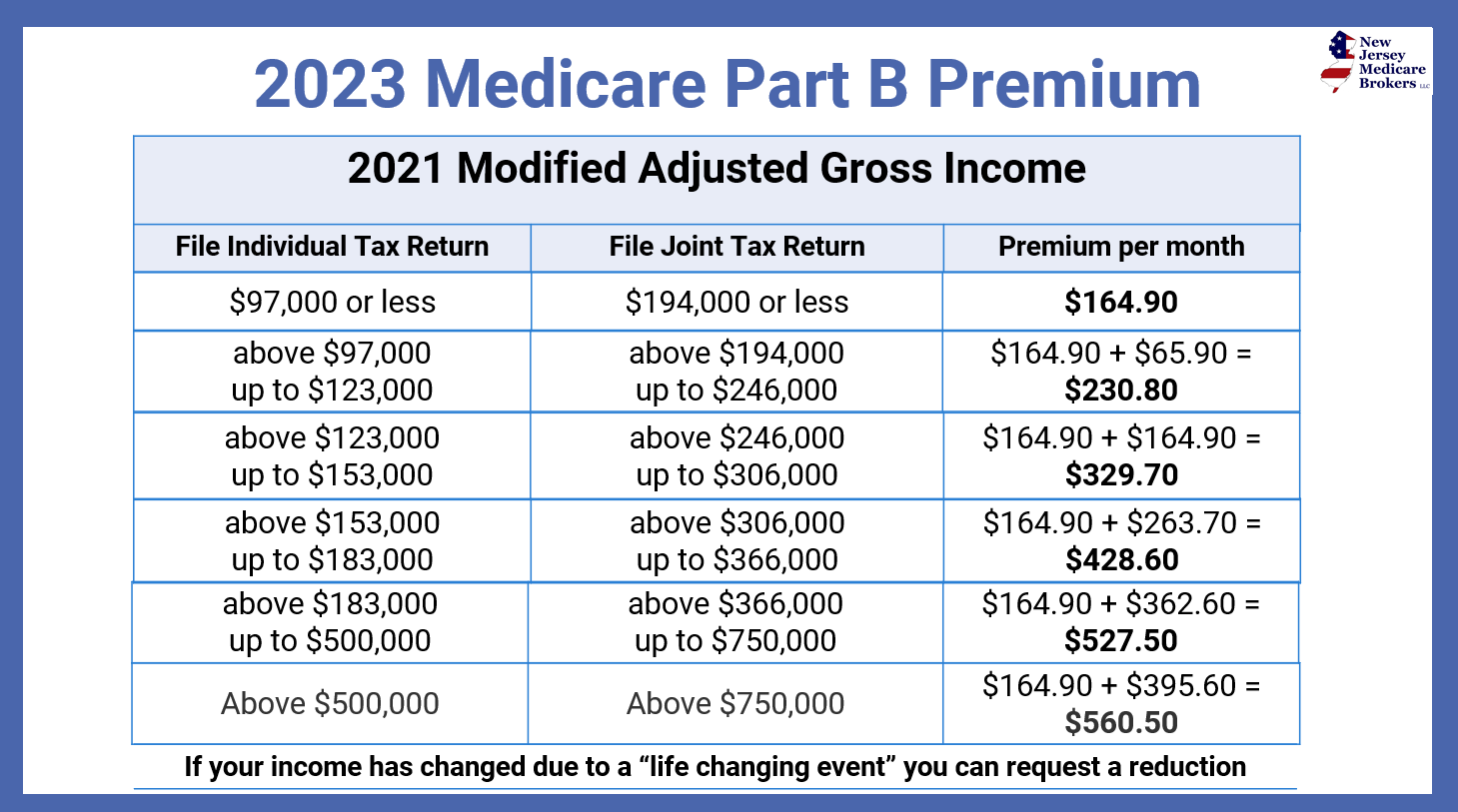

What Is The 2024 Medicare Premium Amount Image to u, — each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act.

Source: chelsyqlouise.pages.dev

Source: chelsyqlouise.pages.dev

Social Security And Medicare Tax Rate 2024 Chart Lonna Virginia, — the 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

Source: zaharawkaren.pages.dev

Source: zaharawkaren.pages.dev

Fica And Medicare Tax Rates 2024 Adara, — 2024 medicare tax rates.

2024